The DCC service (Dynamic Currency Conversion) is now integrated with the GP webpay payment gateway. How does it work? Based on the card number inserted into the payment page, payment gateway GP webpay recognizes the foreign cardholder and offer DCC service automatically. The cardholder can then choose the payment in her/his home currency or in the currency of merchant.

Benefits to Merchants:

- New, ongoing revenue stream from every DCC transaction

- Offers merchants a competitive edge in the marketplace – the opportunity to attract new international Visa and MasterCard cardholders

- Your customers can pay in different currencies, while you can use only one settlement account in your home currency, as till now

- Easy to use: GP webpay payment gateway does it all while providing a familiar shopping experience

- Payments details of your DCC transactions will be displayed in GP webpay portal, Merchant portal and on your regular statement report

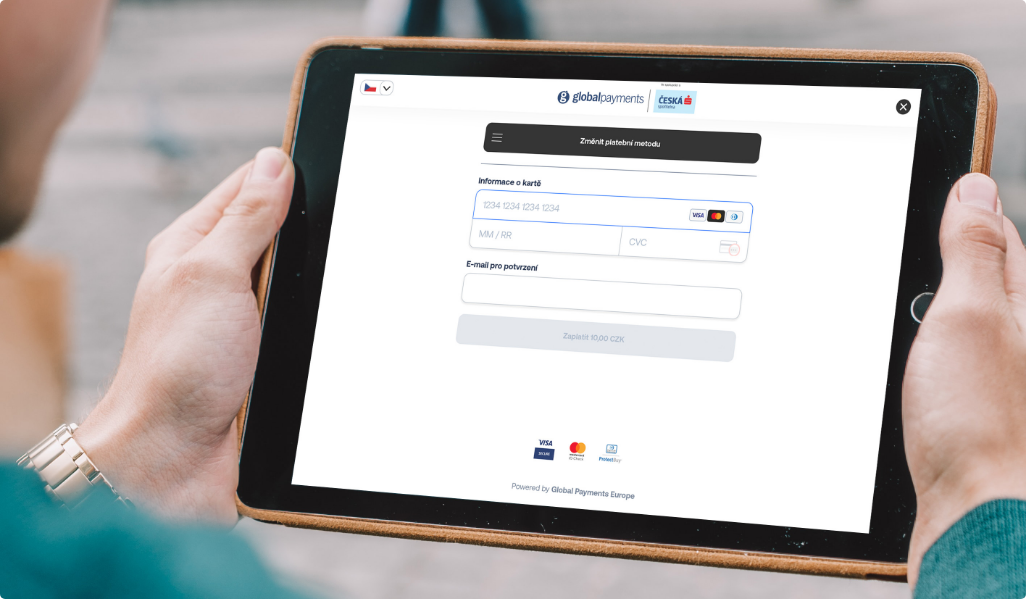

Payment process with DCC:

- Display of DCC offer – the cardholder chooses her/his transaction currency and submits with “Pay” option.

- After the successfully finished payment, the GP webpay payment gateway show the customer receipt. The receipt is shown in a new “pop-up” window. The same receipt is sent also to cardholder’s email address, if it was inserted previously in the payment page.

Note: To show the receipt “pop-up” correctly, some browsers may require adding GP webpay URL address to the list of allowed addresses.

The DCC service can be used without limitation also by merchants, who accept payments in foreign currencies. The payment page with DCC service offer will be displayed only for payments initiated in CZK currency.

What are the advantages of DCC payments compared to the foreign currencies payments?

Operation principle:

DCC payment

- payment is initiated by merchant in CZK

- DCC service converts the amount to cardholder’s currency

- cardholder pays in his/her currency based on the card

- merchant is settled in his currency (CZK)

Foreign currency payment

- payment is initiated by merchant in foreign currency

- cardholder pays in the currency selected by the merchant

- the merchant is settled in the foreign currency

Revenue for the merchant:

DCC payment

- revenue share from foreign exchange creates new and ongoing revenues

Foreign currency payment

- none

Payments without exchange risk?

DCC payment

- foreign exchange is provided by payment gateway, who’s provider bears the FX risk

Foreign currency payment

- merchant bears the FX risk

Zero costs on exchange and foreign currency accounts administration

DCC payment

- none

Foreign currency payment

- merchant pays for the money conversions and for foreign currency accounts administration

Simple administration and accounting

DCC payment

- merchant can stay with the one account in his currency (CZK)

- does not care about the money conversion from foreign currency accounts

- the clearly presented information about the DCC revenue for the merchant are available as a part of regular merchant statement

- DCC service supports tens of foreign currencies

Foreign currency payment

- merchant must administrate foreign currency account for each supported currency.

- the count of supported currencies is limited.

What should be done for the termination of foreign currency payment service for the specific currency and start of the DCC service for the currency?

Ask your sales representative to terminate the foreign currency payment service for a selected currency and start the DCC instead.